Short-Term Investment Options: Need the Money Soon?

/Everyone is looking for a way to make money in the short-term.

The other day a friend of mine was telling me about his meeting at the bank. He was looking at short-term investment options for a small amount of money while he looked for a house within the next year. His banker placed his money in a 6-month non-redeemable GIC at 1%.

If you think this is a good investment option, you may think otherwise after reading this article.

Let’s explore the investment options at your disposal when investing money for less than a year.

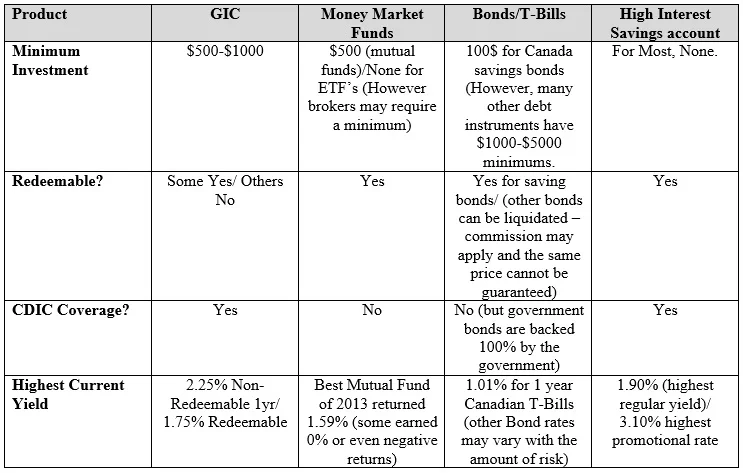

Guaranteed Investment Certificates (GICs): GICs may have looked attractive in the early 80’s when interest rates spiked to 20%, however you will now be lucky if you beat inflation! GICs have been heavily popularized as the ultimate vehicle for guaranteed returns. They are backed by the Canadian Deposit Insurance Corporation (CDIC) for up to $100,000 per institution and come in both redeemable and non-redeemable forms. When investing in redeemable GICs, your money can be accessed prior to the maturity without incurring a penalty. On the other hand, non-redeemable GICs usually cannot be accessed before the maturity and if the money is taken out before the deadline, a hefty fee typically applies. The option of being able to access your money at any time comes at the cost of a lower return. For example, RBC’s current 1-year non-redeemable GIC is posted at 1.30%, while its redeemable solution is quoted at 1.05%. If you have your heart set on getting a GIC, you may want to look at some online banks or credit unions as they typically offer higher rates. The highest current rate for a 1-year non-redeemable GIC is currently offered by Implicity Financial at 2.25% (as of September 18th 2014).

Money Market Funds: The objective of a money market fund has been to maintain a stable net asset value of $1 per share while paying a little interest. This investment instrument is usually very low risk and used for investors wanting to preserve their cash while earning a small rate of return. Money market funds are not insured under CDIC. When buying a money market mutual fund you will be charged a small management expense for the administration of the funds’ assets, which these days tends to erode most of the returns. If you are adamant about purchasing a money market fund, one option that minimizes the management fees is to use an Exchange Traded Fund such as “CMR.TO”, Claymore’s Premium Money Market ETF. However, these days higher return short-term investment options exist. To put it in perspective, after expenses, RBC’s money market mutual fund had a meager yield of 0.62% in 2013. Manulife’s Money market fund had the highest performance in 2013 with 1.59%, which still leaves much to be desired.

Bonds/T-Bills: Treasury bills (T-bills) are used to fund the governments short-term capital needs and are typically offered with maturities ranging from one month to a year. They are not supported by CDIC; however the money is backed by the government which is unlikely to default on its obligations. The minimum investment for T-bills starts at $5,000. They do not pay out interest but are sold at a discount and mature with a payment at full value. The current 1-year Canadian Treasury bill yields 1.01%. Bonds are another alternative the government or corporations use to raise funds however the maturities are usually longer than a year. Nonetheless, regardless of the maturity, bonds can be bought on the financial markets and held for short-term investment purposes. Do note that the value of the bond can fluctuate which may cause you to liquidate your investment at a lower value then when purchased.

High Interest Savings Accounts: Among all of the options, the top tier savings accounts pack the biggest punch. They offer a high amount of flexibility with some of the best returns. Most savings accounts require no minimum investment and are backed by CDIC for up to $100,000. They offer the flexibility of a redeemable GIC, without any fixed term and usually a higher interest rate which is typically paid out on a monthly basis. Many virtual savings accounts offer the highest interest rates and you can often find promotions offering higher periodic rates to lure your deposits. For example, Presidents Choice Financial is currently offering a promotional rate of 3.1% on new deposits, while Tangerine is offering 3%. Of course these offers are only for a three to four month period, however even the regular savings rate of 1.30% is quite a good deal for a hassle-free approach to short-term investing. These high interest savings accounts are also sometime sold like a Mutual Fund with no management fee, so that it can be held in a discount brokerage account. A list of discount brokerage specific offerings can be found here.

**Data found using ratesupermarket.ca and Morningstar.

Next time you’re sitting at the bank being offered a locked-in GIC for your short-term savings needs, think again. Depending on your needs, there are likely much better alternatives out there!