Understanding Your Pension: Defined Contribution the New Norm?

/In the past year, a report by DBRS (a globally recognized provider of credit ratings and opinions) has raised a red flag on defined benefit pension plans following an investigation into 461 pension plan funds in Canada, the U.S., Japan and Europe. They described that at the end of 2012, the average pension fund had just enough money to cover only 78.3 per cent of the future benefits it would have to pay out.

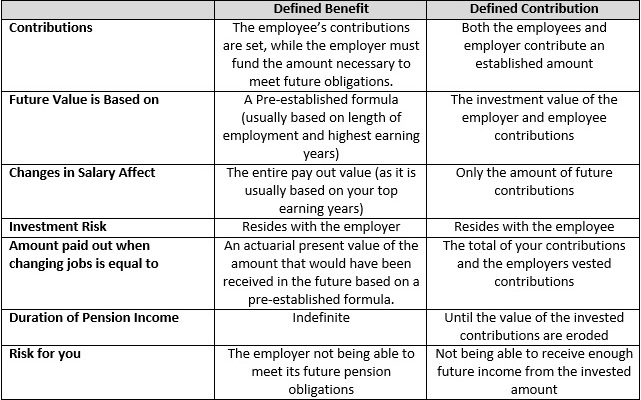

As baby boomers retire, the strain on pension funds has been immense as they will have to meet increasingly large future liabilities. Due to this situation, the past decade has seen a sharp shift towards employers offering defined contribution plans instead of defined benefit plans. Why the big shift? By taking a look at both plans you may notice why employers have been opting for one over the other.

Defined Benefit Plan

For many decades these plans have been the standard for stellar pensions. They have also been called “gold plated” pension plans as they have been highly regarded by employees as the best of the best due to their ability to guarantee you an income stream throughout retirement based on a given formula. These plans were far more popular in the past where employees were prone to work for the same company their whole life and life expectancies were much lower. As things have evolved, these plans have been less favored in the eyes of employers. Life expectancies have drastically increased in the past decade and interest rates are at an all-time low which means companies have had to change their calculations of future pension liabilities for each employee. Many have not; which has pushed many employers into the red in terms of pension funding.

Unless your pension comes from the Canadian government, there is still a slight risk that the company will not be able to meet your promised retirement income until death. As an example, Nortel’s pension was reported to be underfunded by $2 billion and due to Nortel’s insolvency, some pensioners saw their pension income cut by nearly 40%.

Obviously this is an extreme example; typically most plans have been able to meet their future obligations while being able to provide a portion of continuing death benefits to the surviving spouse. Typically this is at least 50% of the income that was received by the pensioner.

Defined Contribution Plan

Forbes has recently reported that the average worker stays at his/her job for 4.4 years. With the decrease in job tenure and the rise in do-it-yourself investors, a defined contribution plan may be the ideal pension plan for the younger generation of employees.

Employers have been supportive of changing to this type of plan as they do not bear the risk of being liable for the future income of retired employees. The contributions are based on a matching principle. For example, the employee may contribute up to 5% of his gross salary with the employer matching that contribution 1 for 1. The commitment for the company typically ends at matching the contribution, therefore having enough funds to retire and obtaining the necessary yields on the invested assets is in the hands of the employee. By doing so, employers have relieved themselves of future responsibilities and placed the burden of fluctuating investment returns in the hands of employees.

This may be a downfall if you were planning on spending your lifetime at one employer since studies have shown that the sum of retirement benefits is typically higher in a defined benefit plan. However, when it comes to short-term employment, the differences are marginal as a major variable in calculating defined benefit payouts is the length of employment. Therefore, the flexibility of defined contribution plans has shown its strength for the new generation of “job hoppers”. If you leave your employer, you will receive the total amount of your contributions and the vested amount of your employers’ contributions which will remain in a locked-in retirement account to be invested in a tax free shelter. If you have left many employers that have offered a pension plan, you will be able to accumulate all of the previous pension funds within your locked-in retirement account in order to invest the funds at your discretion to help meet your retirement income needs. In the case of the pensioner’s death, these plans are also quite flexible as they typically allow the spouse to transfer the entirety of the funds into their RRSP.

Given that the investment risk resides in your hands, proper asset diversification is key to meeting your retirement goals. You must also ensure to build a large enough nest egg to be able to meet your future income needs as life expectancies are likely to continue to rise. You may very well have to stockpile enough funds with the expectation of still being kicking at 100 years old!

Whatever your pension type, it is important to take it into consideration when building your retirement strategy as it will make up a large proportion of your retirement income and can play a decisive role on how you invest your additional savings.