TFSA VS RRSP… which one should I choose?

/Ever since the introduction of the Tax-Free Savings Account (TFSA) there has been a dilemma for many Canadians; where to place their hard earned money, in a TFSA or an RRSP (Registered Retirement Savings Plan)? Since each type of account has its own strengths, the answer will depend entirely on your personal situation.

A recent study by BMO found that less than 50% of Canadians had a TFSA and only 19% knew the annual limit. How can informed decisions be made about the allocation of savings if all options are not clearly understood? Let’s take a look at the differences between a TFSA and an RRSP to see which one is most suitable for you.

The Tax-Free Savings Account

The TFSA was introduced in 2009 by the Government of Canada as a vehicle for individuals aged 18 years and older to earn tax-free returns on an allotted yearly contribution amount. There has been much confusion about this account. Many people initially thought it less useful than an RRSP since you could not deduct the contributions from your taxable income, however since funds withdrawn from an RRSP will be added back to your taxable income, you are simply deferring tax on this income to another year. Depending on your current and expected future tax brackets, TFSA contributions might make the most sense. You should prioritize TFSA savings in the following situations:

- Your Taxable Income will be higher in Retirement: Why would you defer paying $2 today just to pay $3 in the future? Since an RRSP enables you to save taxes in the present to pay them in the future, it is only logical to contribute to a TFSA when your tax bracket will be higher at retirement than it is presently. In Ontario, the lowest tax bracket for 2013 applies to salaries of approximately $40,000 and lower. If you are within this bracket, you should first contribute to a TFSA since your tax rate will not be lower at retirement.

- You will have very low income in retirement: If it is likely that you will be eligible for the Guaranteed Income Supplement (GIS), you may want to contribute to your TFSA. This way, when you take out the money it will not be counted as additional income, nor will it be taxed. This is not the case with an RRSP. As of 2014, the maximum annual income for a single individual to be eligible for the GIS is $16,728.

- Flexibility is a Necessity: Many people do not want their money locked up in an RRSP. The TFSA provides a flexible alternative for short to medium-term goals. Since you can take funds out at any time without a tax consequence, the TFSA is also often used as an emergency fund.

- If you are over the age of 71: After the age of 71, you can no longer contribute to an RRSP account and must convert your RRSP to a Registered Retirement Income Fund (RRIF) and start withdrawing funds. The TFSA account provides a great vehicle to invest surplus income.

When contributing to a TFSA, make sure to not over-contribute as you will be penalized 1% per month for all exceeding balances. If you do take money out of your account, you may only put it back in the next fiscal year. If not, you risk breaking the limit in the event where you had previously maxed out your contributions.

The Registered Retirement Savings Plan

The RRSP is an ancient beast, and before the introduction of the TFSA it was the only tax-advantaged option to save for your retirement. The ultimate benefit of this saving vehicle is the immediate reward of receiving a tax deduction on your contributions. You should consider investing in an RRSP in the following circumstances;

- You are in your top earning years: This is the most common reason for contributing to an RRSP. People rarely max out the entirety of their RRSP limit early in their careers which leaves a large amount of room for your top earning years. If you are in the top tax brackets you will be able to receive a larger return per dollar contributed to an RRSP. Taxes paid on these funds when withdrawn at retirement will potentially be much lower than the tax return you received when you contributed them to your RRSP.

- Your spouse has unused contribution room: In many families, there is usually one higher earning spouse. This is common in families where one person has decided to stop working to take care of the kids. In this case, the higher earning partner can maximize his or her deductions by making a contribution to their spouses RRSP and taking the tax deduction. This shifts future retirement income to the lower earning spouse.

You are self-employed: Owning a business has the perks of being your own boss but lacks the pension benefits offered by most employers. The RRSP is the ideal way of saving for retirement. Once savings are accumulated and you are ready to retire, you can convert your RRSP to a RRIF and schedule monthly withdrawals to create a living allowance.

You are receiving a large bonus: Many employers will reward you for meeting yearly targets by offering a bonus on top of your salary. If you have extra contribution room you can roll your bonus directly into your RRSP where there will be no withholding taxes at source.

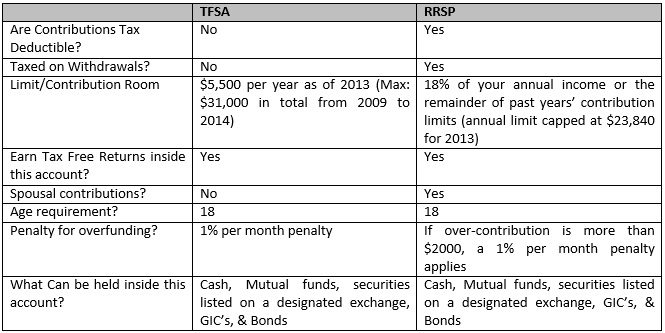

You will find below a comparison of both saving accounts key characteristics.

This tax season, make an educated choice and put your money where you will receive the most benefit to help you enjoy the retirement you always dreamed of having!